Investing in Gold, Diamond & Real Estate

Investing in Gold, Diamond & Real Estate

Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in value. People have numerous reasons to invest. However, it is essential to invest in the product and industry to ensure that some type of profit will be made in the end. The diamond and gold industry commonly catch the eyes of many investors, since the value of these commodity items are consistently high. Yet, some people are more interested in investing in markets that fall into the essentials category, which would be real estate. So why do people do one over the other?

Investment in Diamond/Gold

For those who favor the luxury sector, it might be beneficial to invest in diamonds and gold. For certain people, it is more preferable to invest in diamonds over gold for a few reasons. First, diamonds appreciate in prices. While gold is still a valuable investment, diamonds are seen to hold better investment prospects for buyers. Second, economically strong countries will drive the price of diamonds. Certain countries, like China and the United States, expect the demand for diamonds to increase. Third, diamonds are portable. Despite both diamond and gold having aesthetic value, comparing the two emphasizes that diamonds are more portable. Lastly, there is better inflation hedge on diamonds than gold. The diamond industry does not correlate with the financial market and works independently. This is why the inflation hedge is better for high quality diamonds (“Investing in Diamonds vs Gold: Why Diamond Investments Are More Lucrative In Comparison To Gold”).

There are certain things to keep in mind when investing in diamonds. Prices depend upon the global economy. It is important to judge the quality and real worth of the diamond, so it is essential to make investments in this industry if you understand what this market is all about or if you have contacts within the industry. When purchasing this high-valued gem, it is important to have a clear perception about the buy-back value. These policies differ from jeweler to jeweler, which is why investors need to have clear understandings when purchasing this commodity from a jeweler. Size is not essential, beginners should invest in diamonds with one carat and slowly work your way up. This follows with considering the cuts of diamonds, which can bring more value on the table. Combing the size and carat of the diamond ultimately helps investors consider the resale value of diamonds. If you have a rare piece, it will take more effort to sell that diamond by selling it at auctions or explore different trading platforms. But if the diamond is a medium quality, then there would be more resale value provided (“Investing in Diamonds vs Gold: Why Diamond Investments Are More Lucrative In Comparison To Gold”).

Gold offers distinct advantages that simply cannot be found in almost any other investment. But there are a few risks associated with gold investment, like premium fees, and authenticating older commodity. However, people tend to invest in gold for the wrong reasons which end up putting their financial goals in jeopardy. Some reasons to invest in gold is because it is a hedge against inflation. When inflation rises, the value of currency decreases and almost all major currencies have depreciated in value relative to gold. When inflation remains high, gold becomes a hedge against inflationary conditions. Gold is a tangible asset, allowing a perception of safety to be created among investors. Purchasing gold is easier compared to purchasing other tangible assets, like real estate. Gold is also free from any concern regarding digital storage of information where hackers can access these (“Reasons to Invest in Gold”).

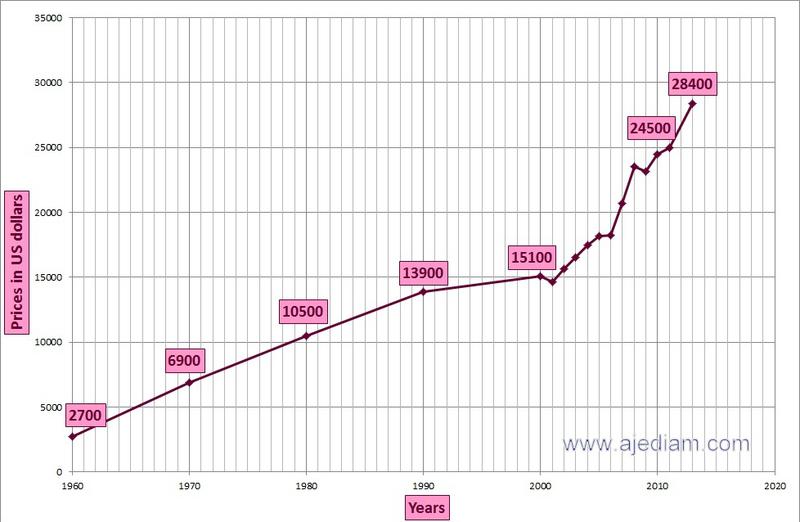

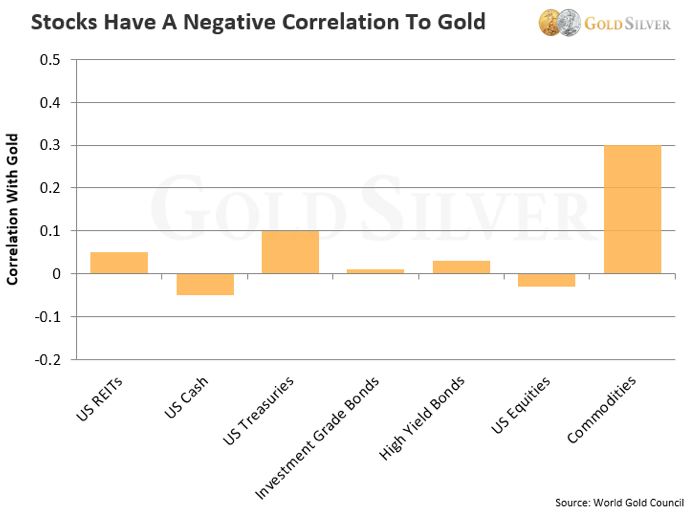

There are more advantages to gold when buying it physically. It has no counterpart risk, meaning the value of it will never be zero. It is private and confidential in terms of no one knowing that you own it. Gold is also liquid and portable, making it easy to authorized resale places. Investments in gold can be liquidated much faster than other physical assets like real estate. It is also easier to store and comes with low maintenance and carrying costs. Gold can also protect an investor’s portfolio during a time of crisis. Looking at the graph below, The value of gold doesn’t correlate with the market. When stock market declines, gold has rise more than actually fall in value. Gold is a natural safe haven when a crisis occurs and fear is rising. Gold ensures that if more people look to invest in times like those, then the prices substantially increase. Gold offers massive profit given the “precarious nature of our economic, financial, and monetary systems” (“Why Buy Gold? 10 Reasons to Invest in Physical Gold Bullion”).

Investment in Real Estate

Investing in real estate is a personal choice and depends on an investor’s pocketbook, risk tolerance, goals, and investment style. It has different risks and opportunities, however, real estate is not as liquid, requires research, a large amount of money and time. Real estate can be sold and bought easily without the hassle of trying to convince someone to purchase the commodity.

Real estate provides better returns, the risk of loss is minimized by the amount of time an investor has a hold of the property. It is important to maintain properties! Real estate also has high transaction costs, where sellers can take from 6% to 10% off of the top of the sale price (“Reasons to Invest in Real Estate vs. Stocks”). When markets continue to improve, the value and equity improve as well. It allows investors to have more control since the property is a tangible asset that can produce numerous revenue streams. Real estate also has a high tangible asset value, as home owners insurance will protect the investment. The values of real estate will increase over time the longer you hold the property. Housing markets have always recovered from previous recessions, and investors thrive when the market is at its peak. There are also numerous tax benefits, such as “tax deductions on mortgage interest, cash flow from investment properties, operating expenses and costs, property taxes, insurance and depreciation (even if the property gains value) and other benefits” (“5 Reasons Why Real Estate Is a Great Investment”).

There are different factors that come into play when investment is on the table. It is important to factor in all the elements and determine where your interests are best held. There are many benefits of investing in gold, diamond, as well as real estate; however, one can be more appealing than the other. Some people may even chose to invest in both! Regardless of what you chose to invest in, investment is a great way to ensure financial security for the future.

Views expressed in this post do not constitute as financial advice in any way. Points mentioned do not constitute as investment recommendation, nor should any data be relied for any investment activities.

PHERES strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decision.