Could Color Diamonds Be A Good Alternative Investment?

Could Color Diamonds Be A Good Alternative Investment?

At the end of 2019, professionals predicted that a great market shift is coming in 2020. And here we are, 70 days into the new decade seeing unprecedented changes in the markets from all sectors and industries.

A global slowdown in activity is bound to affect the overall volatility of the markets. With the unpredictable ups and downs in the economy worldwide, people are seeking real alternatives and it is in times like this that we appreciate physical commodities.

Gold prices soared 20% in 2019, hitting a peak in September. With recession fears and global uncertainty, this ‘safe-haven’ asset was a trusted commodity. The upsurge in gold prices has impacted the jewelry industry that uses gold as a commodity material instead of a commodity asset. The increasing gold prices and decreasing diamond prices are interlinked according to an analyst at Citigroup.

One company had solitarily controlled the diamond industry and prices in the twentieth century in generality. Presently, diamond prices are completely driven through supply and demand. An oversupply of rough diamonds surfeit of polished stones and falling prices of diamonds have put pressure on mining organizations as well as polishers and traders.

With that said, diamonds as an investment continues to soar for the following reasons.

* Durable – A diamond doesn’t break or wear off. They are the hardest substance on Earth.

* Inflation Proof – Diamonds are durable and movable than most other physical commodities such as, real estate, gold or other precious metals. Diamonds generally appreciate in compliance to inflation.

* Portable Asset– Diamonds are enduring, portable assets of huge value.

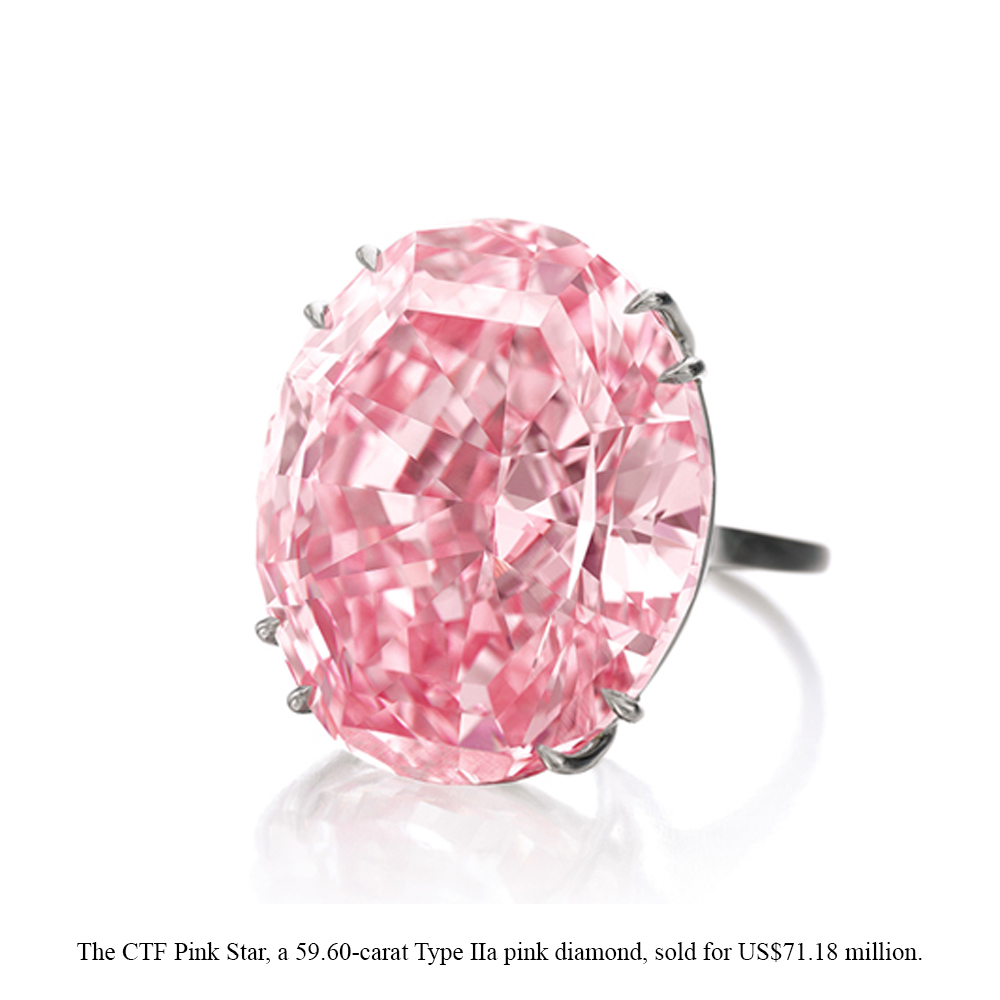

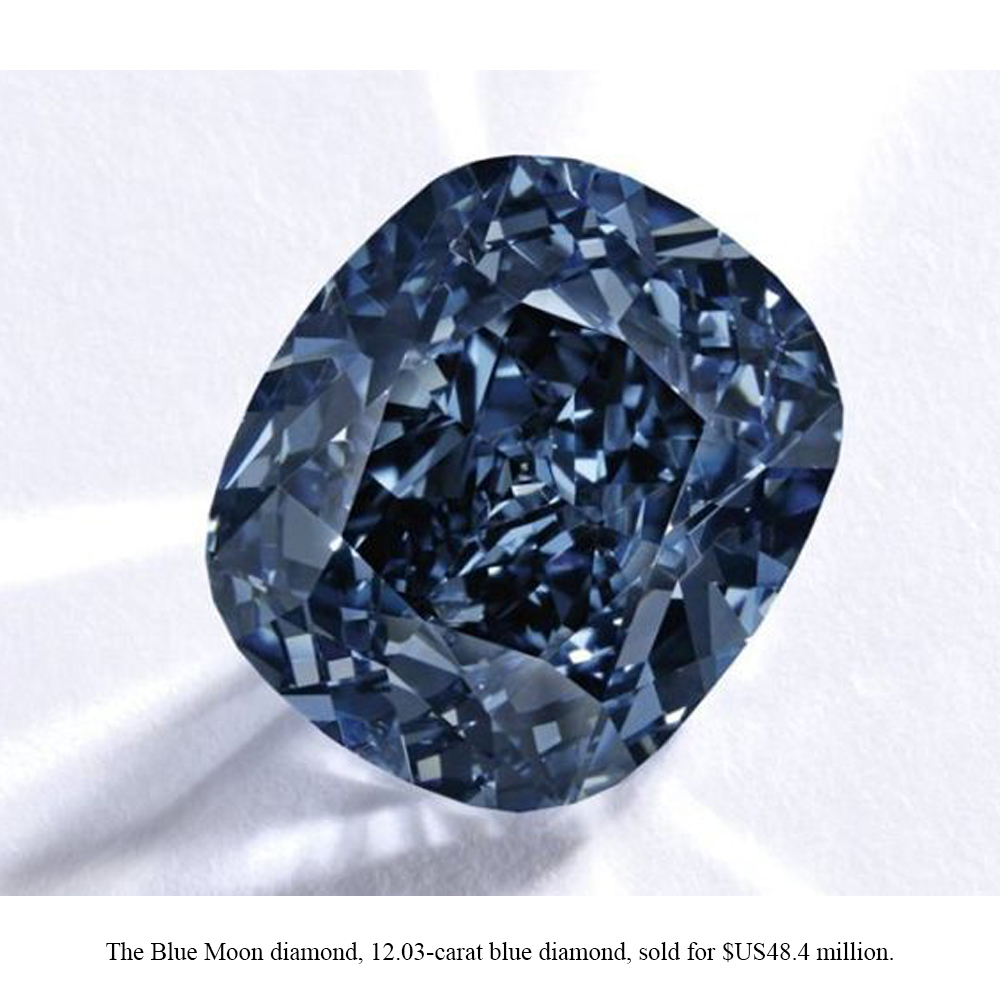

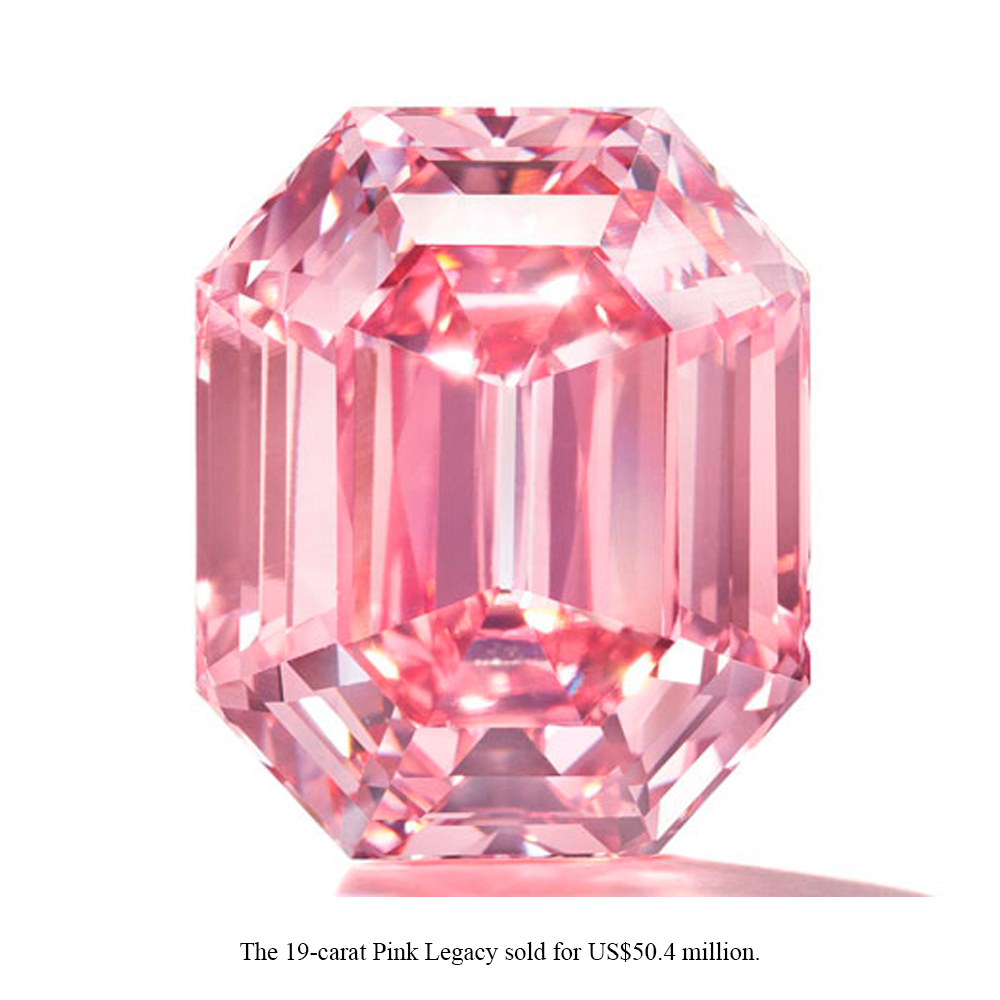

Making waves are color diamonds. They continue to show promising results and a healthy rise in appreciation. Over the past decade (2010-2019) fancy colored diamonds showed a steady market price increase of 77% according to the Fancy Color Research Foundation (FCRF). Pink diamonds were leading the color diamond market that increased by 116%. Additionally, blue diamonds soared 81% followed by yellow diamonds by 21%.

Over the past decade, these rare one-of-a-kind stones achieved significant return on investment.

* 5-carat Fancy Pink diamond increased by 99%

* 1-carat Fancy Vivid Blue increased by 135%

* 3-carat and 5-carat Fancy Vivid Yellow increased by 30%

In the past 3 years, most colored diamonds were bought with the intention of investing than it’s visual appeal.

To maximize and achieve the highest ROI when liquidating, it is crucial for a diamond investor to understand the supply-demand balance. The steady demand for pinks and blues with a limited supply continues to make them a highly coveted and sought after investment piece.

The rarity and perfect 4Cs of fancy colored diamonds alongside the supply and demand showed a constant price rise. Most of the rare blue and pink diamonds are pre-owned stones that appear in auctions.

The anticipating closure of the Argyle diamond mine (fourth largest diamond producer in the world) brings forth new possibilities for colored diamonds. The Argyle mine provided 90% of the world’s pink diamonds including the most precious and rarest hues ever to exist. It has been a pioneer for reshaping consumer impressions of colored diamonds.

As the supply for pink diamonds decelerate, fluorescent diamonds are likely to flourish. These diamonds glow when placed under UV light. Fluorescent diamond prices are already seeing an increase.

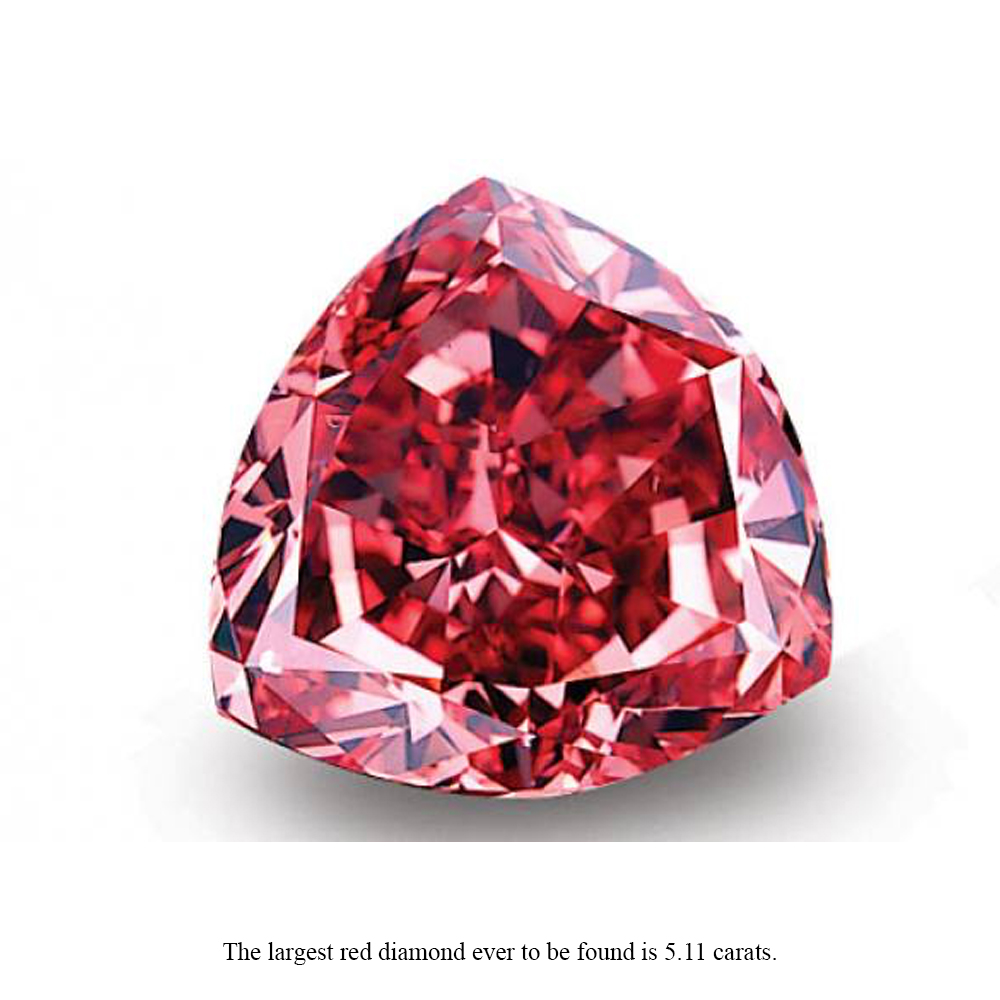

Most Expensive Color Diamonds Ever Sold on Auction

Red diamonds are the rarest fancy colored diamonds ever to exist. They are highly sought after and as supply is uncertain and limited, it steadily rises in price.

Quoting Advisory Board Member, Jim Pounds of FCRF, “From the mining perspective we are currently experiencing a shortage in high quality fancy color rough and we therefore feel quite optimistic about the future.”

As more investors and diamond enthusiasts are educated about the potential investment in the diamond industry the more prosperous and competitive the cycle will become.